Challenges of the chemical industry: status quo 2024

Alex Böser

Author: Alex Böser, Senior Ecosystem Manager Chemistry @ 5-HT Chemistry & Health

Introduction

Solving today’s sorrows with tomorrow’s possibilities: With novel technologies such as GenAI advancing the frontier of science at tremendous speed on one side and economic, regulatory, and political challenges weighing down the industry on the other side, it’s now “go or gone” for many chemical companies.

What are the current challenges the industry is facing and what chances can be leveraged to overcome them?

In this article, we’ll have a look at the challenges the chemical industry must overcome in 2024. For a detailed review of the chances in 2024, have a look at this article [LINK].

-800.jpg)

Challenges of the global chemical industry

Taking a glance at economics and production data, the chemical industry seems to be divided into two geographical parties: Asia (mainly China, but also Japan and South Korea) and the rest of the world (mainly consisting of Europe as well as North & South America).

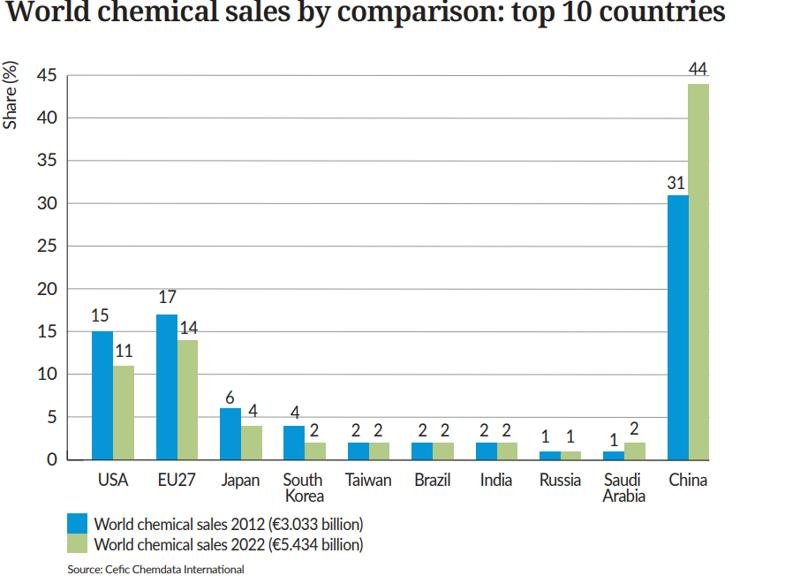

Looking at the world chemical sales in 2022 [1], China is by far the largest chemical producer in the world, followed by Europe and the USA (see Figure 1):

Figure 1 – World chemical sales in the year 2022, depicted as size-referenced dots on a world map including the value of world chemical sales in EUR. Total sum: 5.434 billion EUR. [Source: Cefic Chemdata International]

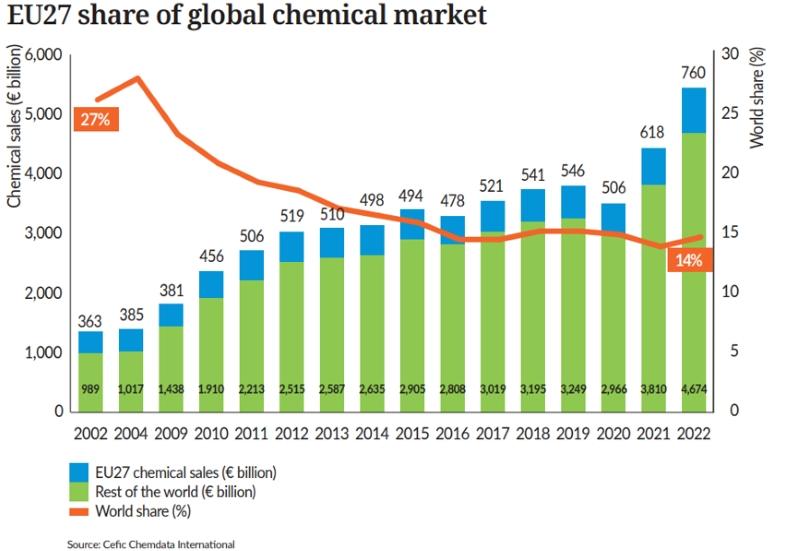

But not only does China dominate the list on world chemical sales, its market share increased significantly between 2012 and 2022 (see Figure 2), while Europe – specifically the EU27 countries – lost almost 50% of its world chemical sales shares over the last 20 years (see Figure 3) [1].

Figure 2 – World chemical sales by comparison: top 10 countries. Depicted in blue and green are the values for the world chemical sales for specific countries/regions for 2012 and 2022, respectively. [Source: Cefic Chemdata International]

Figure 3 – EU27 share of the global chemical market. Depicted in blue and green are the values of chemical sales (in billion EUR) for EU27 and the rest of the world, respectively. The orange line depicts the percentage share of EU27 chemicals sales of the world chemical sales. [Source: Cefic Chemdata International]

China alone is therefore responsible for almost half the global sales in the chemical market.

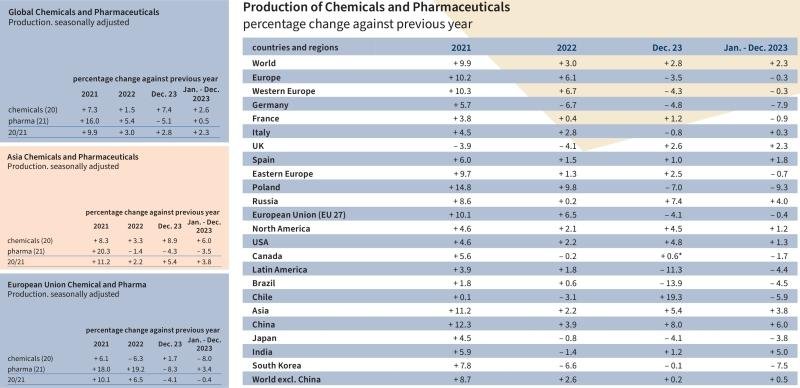

Lastly, the global chemical market and production is slightly growing - whereas China seems to be the victor and Europe the loser in the equation: The year-over-year production of chemicals increased by 2.6% globally for 2023, with Asia (and especially China) increasing their chemical production by 6.0% while EU27 decreased its chemical production by 8.0% (see Figure 4) [2].

Figure 4 – On the left: 3 Tables depicting the year-over-year percentage changes in chemicals and pharmaceutical productions in the years 2021, 2022 and 2023 globally (top left), Asia (middle left) and EU27 (bottom left). On the right: Table depicting the year-over-year percentage changes in chemicals and pharmaceutical productions in the years 2021, 2022 and 2023 for the world and specific regions and countries. [Source: Chemdata International and VCI]

In total, the chemical industry – and especially the European chemical industry - is not doing great. But why is that?

Quo vadis Europe?

According to the European Chemical Industry Council (Cefic), this is “due to factors such as

an aging population,

market maturity,

high energy and labor costs,

regulatory burden, and

an increasingly competitive global market.” [1]

In the text and figures above, we have already covered the global market issues and the dominating role of China and Asia. [We’ll publish a separate article soon, focusing on how China became and remains so dominant in the chemical industry.]

Unfortunately, a lot of the aforementioned factors – like high energy costs and regulatory burdens - are largely outside of the control of the chemical companies affected by them. For instance, some are caused by third parties (geopolitical tensions and war, regulations, et cetera) or higher forces (COVID-pandemic and its aftermath).

To address the other factors more specifically, let’s look at the exemplary case of Germany and its chemical industry.

Exemplary case: Germany

According to the German Federation of Chemical Employers’ Associations (BAVC), the productivity of the German chemical industry decreased by 18.6% since 2010, while simultaneously prices of chemical products increased by 32.4% as well as wages and benefits under labor agreements have increased by 34.4% and 44.0%, respectively [3].

Addressing the aging population issue, the Federal Statistical Office of Germany (DESTATIS) predicts, that

“The number of people of working age between 20 and 66 will decrease in the coming years. There are currently 51.4 million people in this age group in Germany. Even with high net immigration, there would be a slight decrease of 1.6 million people by the mid-2030s. With low net immigration, the number could fall by 4.8 million people.” [4, translated from German]

“By the mid-2030s, the number of people of retirement age (aged 67 and over) in Germany will rise from the current 16.4 million to at least 20.0 million.” [4, translated from German]

Lastly, concerning high energy prices: according to DESTATIS, electricity prices for industrial energy consumers saw a 1.4x increase on average between 2015 and 2023, while natural gas prices for industrial energy consumers increased by 4x on average at the same time, reaching an all-time high of 6.2x in mid-July 2022 [5].

Leaving aside regulatory aspects (which are addressed below), Germany is a good example for the precarious situation of the European chemical industry: The German workforce is getting smaller and older, energy and labor prices are very high (even compared to other EU-27 countries) and its productivity is decreasing. In combination with being known for a high amount of bureaucracy and low level of digitalization, these factors will be some of the key challenges the German chemical industry has to overcome in the near future.

Specialty chemicals: A savior in dark times?

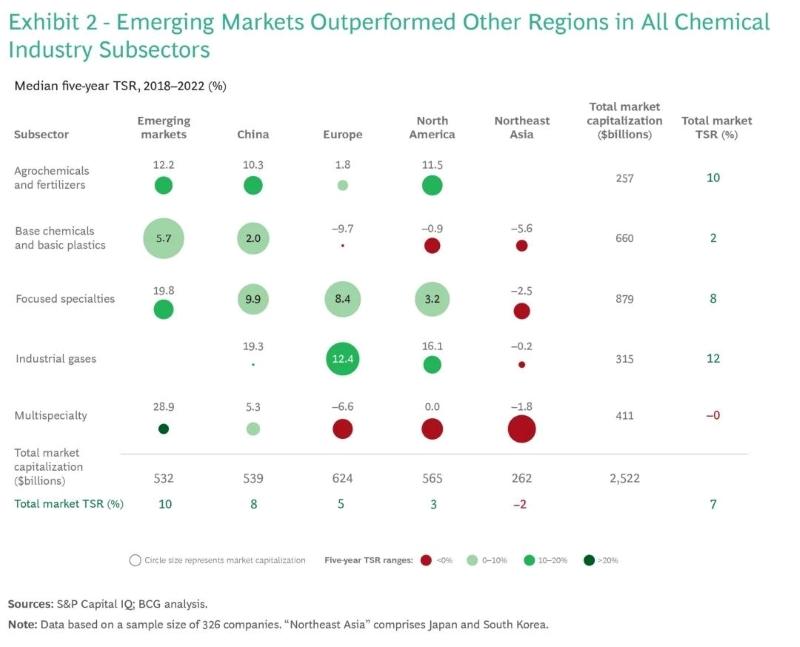

Interestingly, not all chemical sectors are affected in the same manner: According to the Boston Consulting Group (BCG), companies focusing on specified portfolios seem to alleviate these pain points and are capable of maintaining growth (see Figure 5) [6]:

Figure 5 – Table depicting the median five-year Total Shareholder Return (TSR) in the period of 2018-2022 (in %) for different industry subsectors and countries/geographical regions as well as the total market capitalization (in billion USD) and the total market TSR (in %). For ease of visualization, the circle size represents the market capitalization of the individual combination of subsector and region, whereas the circle color represents the different five-year TSR ranges. [Boston Consulting Group]

The median five-year Total Shareholder Return (TSR) for the period of 2018-2022 amounted to +8% for the total chemical market of focused specialty chemicals.

Companies focusing on the subsector of industrial gases were even able to achieve a median five-year TSR of +12% for the total market. Here, Europe and North America even take the lead with +12.4% and +16.1%, respectively – while also boasting the highest total market capitalization.

In comparison: European companies focusing on multispecialty chemicals or base chemicals & plastics had a median five-year TSR of -6.6% and -9.7% (respectively) in the same reference period.

Although not really present in the sector of industrial gases, companies located in emerging markets shine with the highest TSRs in this analysis, boasting up to 10x higher growth values compared to European or US counterparts.

In summary: localization and specialization seem to be a discerning factor for chemical companies in order to maintain growth. Companies with basic and/or very broad portfolios might need to restructure their products or downsize their portfolios to remain relevant.

It’ll be very interesting to see, whether this trend continues or if in the end the chemical industry as a whole sits “in the same boat”.

Sustainability: New age or nailing jelly to the wall?

The chemical industry (as well as chemistry itself) is often associated with being dirty, harmful, and/or artificial. The narrative seems to be “synthetic vs. natural”, “chemistry vs. nature”.

Historically speaking, the chemical industry has indeed relied heavily on raw oil and natural gas in the past. With these resources becoming scarcer and more expensive every day, as well as consumers and companies increasing their eco-awareness, there is a huge demand for sustainable options and initiatives in the chemical industry.

This demand gives rise to a vast number of chances and challenges.

On one hand it offers the chance to redefine a whole industry and its image. On the other hand, this requires huge investments in innovation, infrastructure, technology and people, as well as standardization and regulatory guidance/compliance.

Let’s have a more detailed look at [some] of these factors:

Regulatory example: European Union

In December 2019 the European Commission published the European “Green Deal”, an initiative to produce at least 55% less net greenhouse gas emissions by 2030 (compared to 1990 levels) and to become the first climate-neutral continent by 2050 [7].

Since the chemical industry is an integral part of value chains of other industries as well as a large contributor for greenhouse gas emissions, the European commission published a more detailed and specified strategy for the chemical industry, the “EU chemicals strategy for sustainability towards a toxic-free environment” in October 2020 [8].

This strategy outlines over 80 actions and sets an indicative timing for their implementation. These actions include:

“banning the most harmful chemicals in consumer products - allowing their use only where essential,

account for the cocktail effect of chemicals when assessing risks from chemicals,

phasing out the use of per- and polyfluoroalkyl substances (PFAS) in the EU, unless their use is essential,

boosting the investment and innovative capacity for production and use of chemicals that are safe and sustainable by design, and throughout their life cycle,

promoting the EU’s resilience of supply and sustainability of critical chemicals,

establishing a simpler “one substance one assessment” process for the risk and hazard assessment of chemicals,

playing a leading role globally by championing and promoting high standards and not exporting chemicals banned in the EU” [8]

In short, the European chemical industry is facing a herculean task to become more sustainable.

Much has already been said and is to be said about the European Green Deal and the EU Chemicals Strategy – more than this article can cover. Have a look at this 2022 article by my former colleague Katharina at 5-HT [9] for a more in-depth review. The same is to be said about the proposed ban of PFAS chemicals by the European Chemical Agency (ECHA), leading to over 5600 official comments and change requests from industrial organizations, consultancies, and specialists [10].

One thing is for sure: These goals can only be met by restructuring and challenging the status quo of our industry – engulfing all sectors from procurement and sales to R&D, production, and recycling.

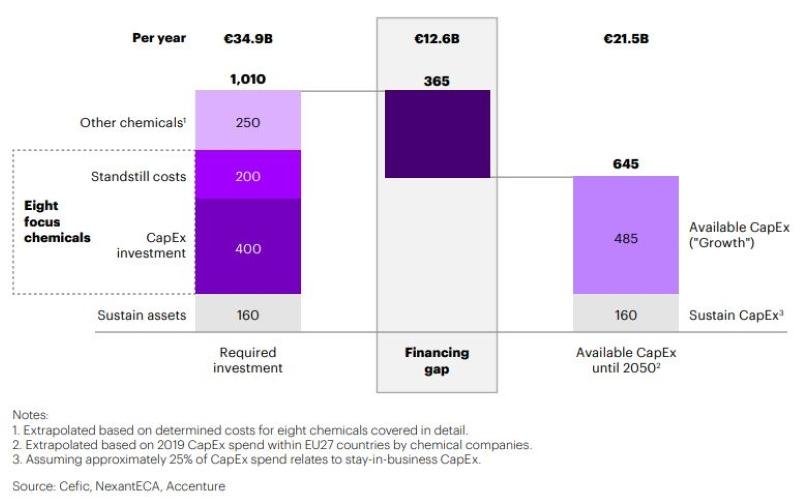

A study conducted by Accenture and NexantECA for 8 focus chemicals (which are responsible for 75% of the industry’s emissions) shows, that a total investment of >1 trillion EUR over the next three decades is required to meet the 2050 net-zero goals (see Figure 6) [11].

Figure 6 - The industry’s EU Green Deal funding gap for the period of 2021–2050 (in billion EUR). The “eight focus chemicals” of the study are: ammonia, ethylene, propylene, soda ash, nitric acid, carbon black, caprolactam and fluorochemicals. [Accenture and NexantECA]

According to Figure 6, the chemical industry sports an investment gap of 365 billion EUR over the next 30 years - requiring an increase in capital investments of 12.6 billion EUR per year.

Is such a huge yearly investment even possible or realistic?

Here’s an oversimplified calculation:

Measured on the fiscal year 2022, BASF is the leading chemical company in Europe based on its revenue [12]. Between 2005 and 2022, BASF had an arithmetically averaged net income of 3.95 billion EUR per year [13]. With a total sales revenue of 87.3 billion EUR in 2022, BASF was responsible for approx. 11.5% of the 760 billion EUR total sales revenue of the European chemical companies in 2022 [1, 14]. Theoretically speaking: if BASF were forced to make investments according to its market share, it would have to accommodate for 11.5% of the yearly 12.6 billion EUR gap - resulting in additional yearly investments of 1.45 billion EUR by BASF alone (~37% of its averaged yearly net income).

This oversimplified approach unfortunately leaves many questions:

How to determine, how much each European chemical company must invest to close the gap mentioned above?

Should such a (theoretical) calculation be based on the company’s market share, its share on greenhouse gas emissions or other values?

Should there be an overseeing institution in place regularly analyzing the investment progress of the companies?

Additionally, the feasibility of such calculations for investments of individual companies to reach the 2050 net-zero goal is to be questioned: the impact of investments into R&D, innovation and other not-yet developed technologies as well as the impact of investments for offsetting of emissions or recycling technologies are difficult (if not impossible) to evaluate for the next three decades.

Regardless of the actually required investments and accompanying calculations: the required investments to reach net-zero are and will be more than just “pocket money”. Money that might not even be available to be spend towards sustainability, because of the difficult market situation. And with every year going by without making these kind of sustainability investments, the “sustainability bill” is just adding up. Maybe even reaching a point, where it will practically and financially be impossible to reach net-zero by 2050.

Standardization

As discussed in the section above, “sustainability” as a concept is difficult to quantify. A common way to evaluate a company’s sustainability is to analyze parameters such as greenhouse gas emissions, water footprint or carbon footprint.

Since the chemical industry is severely complex and a supplier/basis for many other industries, calculating even these parameters can bear obstacles: supply chains, production & conversion techniques, as well as R&D and product life cycles must be considered. This requires standardization of the assessment, calculation, and reporting of these parameters throughout a product’s entire life cycle and various processing industries. Again, this is associated with non-neglectable costs and upfront investments.

A good example for an initiative to standardize the calculation and reporting of product carbon footprints (PCFs) for chemical products is called “Together for Sustainability (TfS)”. Founded in 2011, its aim is to support and coordinate “the measurement of sustainability performance of chemical companies and their suppliers. Results are shared with all TfS members, enhancing efficiency and cost-effectiveness while simultaneously encouraging industry-wide collaboration and continuous improvement” [15].

Although TfS is an innovative and cooperative example in this field, it requires the widespread adoption of its guidelines within the chemical companies as well as its suppliers and/or customers to be effective.

Honorable mentions: Innovation & Technology, Infrastructure and People

Since the topics of “innovation & technology”, “infrastructure”, and “people” regarding sustainability are too important and complex to be subsumed in this single article, just a few observations and thoughts are mentioned here. For a detailed review of these individual aspects, have a look at the corresponding articles [which will be published in the near future].

5-HT specializes in scouting, evaluating, and implementing innovation & technology in the chemical industry for partners in our ecosystem and beyond. Here, our two main focuses are digitalization (self-driving labs, in silico R&D, …) and sustainability (bio-based feedstocks, novel & specialized materials & chemicals, …). If you are interested in learning more about how innovation in sustainability can benefit your company, have a look at this article for a general overview [coming soon] or talk to us directly for an individual approach.

An interesting exemplary case for sustainability infrastructure is the use and supply of Hydrogen as energy carrier: although hydrogen can be produced from water with high efficiency, this production method (as well as others) for hydrogen requires a large amount of energy, e.g. in the form of electricity. Where will this energy be coming from in the future? Also, hydrogen is the smallest molecule in existence, making it notoriously difficult to transport due to leakage. Conversion to easier-to-transport hydrogen carriers, such as ammonia (NH3) or methanol (MeOH), again requires additional energy and/or technology. These and many more challenges are addressed in this article [coming soon].

Lastly, another huge impact factor on a company’s sustainability are its employees. Not only is their work paramount for the research, development, and production of the chemicals, but also are their habits and mindsets large contributors to a company’s sustainability efforts: Human error leads to accidents, machine downtimes and production delays. With a steadily decreasing workforce (see above) and new generations entering the job market, chemical companies must heavily invest in their attractiveness as an employer. Upskilling, novel training technologies and agile leadership are three of the key elements discussed in this article [coming soon] to make the employees of the chemical industry ready for a net-zero future.

Summary

As extensively discussed above, the chemical industry is at a turning point while facing several challenges at once:

If China’s current dominance continues in this decade, the rest of the world must either find its own place or will be put into place in this competitive market. Localization, specialization and cooperating with other companies are just three possibilities to make a stand here.

Each of these steps might involve huge investments, especially regarding sustainability. One might even raise the question, whether European chemical companies can even afford the “luxury” of becoming net-zero in a down market.

Either way: the current problems and challenges can also be used as a chance to cast off some of the “wealth baggage” companies have accumulated over the last years and decades. Swinging off trodden paths will lead to new victors as well as new losers in the current market.

Digitalization is one of the essential tools to prepare the chemical industry for its ever-changing future. But becoming digital is not done overnight and comes with its own challenges. A thorough investigation of the chemical industry’s current chances is conducted in this article [LINK].

Our aim is to publish an updated and revised version of this article focusing on the current challenges of the chemical industry at least once per year.

Comments, questions, and discussions regarding this article are therefore highly appreciated! Feel free to contact the author of this article, Alex Böser (Senior Ecosystem Manager Chemistry @ 5-HT), via e-mail [alexander.boeser@5-ht.com] to share your opinion.

Sources

[1] Cefic Chemdata International (2024), 2023 Facts and Figures of the European Chemical Industry. Cefic website: https://cefic.org/a-pillar-of-the-european-economy/facts-and-figures-of-the-european-chemical-industry/

[2] VCI and Chemdata International (2024), World Chemistry Report. VCI website: https://www.vci.de/die-branche/wirtschaftliche-lage/vci-world-chemistry-report-produktion-weltweit-chemische-und-pharmazeutische-industrie.jsp

[3] BAVC, Chemdata and Federal Statistical Office of Germany (2024), Tarifrunde 2024. BAVC website (entry of 02.02.2024): https://www.bavc.de/top-themen/2287-chemie24

[4] Federal Statistical Office of Germany (retrieved on 28.02.2024), Demografischer Wandel. DESTATIS website: https://www.destatis.de/DE/Themen/Querschnitt/Demografischer-Wandel/_inhalt.html

[5] Federal Statistical Office of Germany (retrieved on 28.02.2024), Daten zur Energiepreisentwicklung – Lange Reihen bis Januar 2023. DESTATIS website: https://www.destatis.de/DE/Themen/Wirtschaft/Preise/Erdgas-Strom-DurchschnittsPreise/_inhalt.html#_1c8sm8agr

[6] Gocke et al., Boston Consulting Group (BCG) (2023), Value Creation in Chemicals 2023 – Facing Unprecedented Pressures. BCG website: https://www.bcg.com/publications/2023/resilience-chemicals-industry

[7] European Commission (2019), European Green Deal. European Commission website: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal_en

[8] European Commission (2020), EU chemicals strategy for sustainability towards a toxic-free environment. European commission website: https://environment.ec.europa.eu/strategy/chemicals-strategy_en

[9] Kittelberger, 5-HT Chemistry & Health (2022), The future of the European Green Deal: Impact of the crisis and the EU chemicals strategy on the chemical industry. 5-HT website: https://www.5-ht.com/en/media/blog/the-future-of-the-european-green-deal-impact-of-the-crisis-and-the-eu-chemicals-strategy-on-the-chemical-industry

[10] Umweltbundesamt (UBA) (2023), ECHA erhält über 5.600 Kommentare zum PFAS-Beschränkungsvorschlag. UBA website: https://www.umweltbundesamt.de/themen/echa-erhaelt-ueber-5600-kommentare-pfas

[11] Accenture and NexantECA (2022), The chemical industry’s road to net zero: Costs and opportunities of the EU Green Deal. NexantECA website: https://www.nexanteca.com/news-and-media/eu-green-deals-impact-global-chemicals-industry

[12] Statista (2024), Revenue of the leading chemical companies in Europe in FY2022. Statista website: https://www.statista.com/statistics/443135/top-chemical-companies-in-europe-by-turnover/

[13] Statista (2023), BASF's net income from 2005 to 2022. Statista website: https://www.statista.com/statistics/265658/net-income-of-basf-since-2005/

[14] BASF (2024), Full-Year 2022 Reporting and Investor Update. BASF website: https://www.basf.com/global/en/investors/calendar-and-publications/calendar/2023/full-year-results-2022.html

[15] Together for Sustainability (TfS), What we do. TfS website: https://www.tfs-initiative.com/what-we-do

Related posts

You may be interested in these articles:

5-HT Chemistry & Health Newsletter

Want the latest tech and industry news, events, relevant info from the ecosystem and more?

Subscribe to 5-HT Newsletter now Subscribe to 5-HT Newsletter now

Become part of the 5-HT Chemistry & Health

Exchange ideas with innovative startups and future-oriented companies in our ecosystem. We look forward to meeting you!