Chances of the chemical industry: status quo 2024

Alexander Böser

Author: Alex Böser, Senior Ecosystem Manager Chemistry @ 5-HT Chemistry & Health

Introduction

With China’s ever-growing dominance on the global chemical market, geopolitical tensions affecting supply chains and prices, as well as challenging regulatory burdens (e.g. the EU Green Deal), there has seldomly been such a pressure on the chemical industry to reinvent itself. Novel and innovative technologies, digitalization and sustainability are three of the main chances to be leveraged here. Read on for a detailed analysis of the chemical industry’s current chances in 2024:

For a detailed review of the challenges the chemical industry is facing in 2024, have a look at this article [LINK], where some chances were already teasered, which will be further discussed here.

First, this article will address the chances arising from specialization and localization in the chemical industry by analysing two exemplary cases: Evonik Industries AG (specialisation) and the Indian chemical industry (localization). Afterwards, future drivers for demand in the chemical industry are addressed - namely energy transition, bio-based feedstocks and recycling technologies. Lastly, the current chances presented by leveraging digitalization, data and data-driven decision making are analysed.

Chances of the global chemical industry

As already extensively discussed in a previous article [LINK, challenges in 2024], China’s dominance on the global chemical market has been growing by a 13% total market share within the last decade - while European and US companies are losing their grip on the market [1]. Since China’s position is very likely to remain strong within the next few years [article follows soon], the rest of the world must double down on securing its own position.

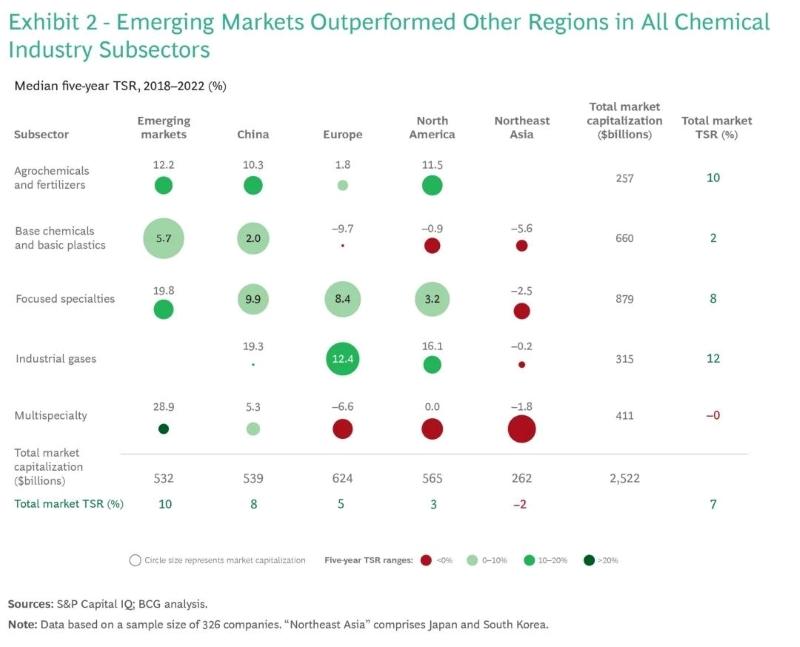

In our aforementioned article we also highlighted the aspects of localisation and specialisation, which seem to play a vital part in maintaining growth: In the period of 2018-2022 the median five-year Total Shareholder Return (TSR) was +8% for the total chemical market of focused specialty chemicals and +12% for companies focusing on the subsector of industrial gases [2]. As depicted in figure 1, companies from emerging markets boast the highest TSRs in this analysis by the Boston Consulting Group (BCG).

Figure 1 - Table depicting the median five-year Total Shareholder Return (TSR) in the period of 2018-2022 (in %) for different industry subsectors and countries/geographical regions as well as the total market capitalization (in billion USD) and the total market TSR (in %). For ease of visualization, the circle size represents the market capitalization of the individual combination of subsector and region, whereas the circle color represents the different five-year TSR ranges. [Boston Consulting Group]

Figure 1 - Table depicting the median five-year Total Shareholder Return (TSR) in the period of 2018-2022 (in %) for different industry subsectors and countries/geographical regions as well as the total market capitalization (in billion USD) and the total market TSR (in %). For ease of visualization, the circle size represents the market capitalization of the individual combination of subsector and region, whereas the circle color represents the different five-year TSR ranges. [Boston Consulting Group]

At a first glance, the rule-of-thumb for maintaining growth in the chemical industry seems to be: “specialization” for EU/US companies and “localization” for companies in emerging markets.

Let’s take a look at two exemplary cases to test this hypothesis: The specialty chemicals company Evonik Industries AG and the emerging chemical market of India.

Exemplary case “specialization”: Evonik Industries AG

Evonik Industries AG (“Evonik”) is a European specialty chemicals company headquartered in Germany. “The company is active in more than 100 countries around the world and generated sales of €15.3 billion and an operating profit (adjusted EBITDA) of €1.66 billion in 2023” [3]. Evonik has over 33.000 employees worldwide and consists of five business units: “specialty additives”, “nutrition & care”, “smart materials”, “performance materials” and technology & infrastructure” - which are further divided into a grand total of 23 business lines.

After securing only moderate year-over-year (YoY) losses in external sales in 2019 (-1%) and 2020 (-7%), Evonik sported a YoY growth of external sales of +23% in 2021 and +24% in 2022. However, external sales volumes have been on a steady decline for 7 quarters in a row since Q2 2022 and Evonik reported a decrease of -17% in YoY external sales for 2023 [4].

Is Evonik then an exception from the aforementioned rule-of-thumb? The answer: it’s complicated!

Although this decrease looks harsh at first glance, it’s mostly circumstantial due to the two exceptionally strong fiscal years prior to 2023. The 15.3b EUR in external sales in 2023 still surpassed the external sales values for 2021 (15.0b EUR), 2020 (12.2b EUR) and 2019 (13.1b EUR) [4].

Nevertheless, Evonik’s C-suite seems to take this as a sign (or chance?) and announced an update to their reorganization program called “Evonik Tailor Made” in their “Q4 / FY 2023 Earnings Conference Call” in March 2024: Total savings of 400m EUR are targeted by the end of 2026 through various steps, mainly related to personnel costs.

While this also includes the reduction of up to 2.000 employees by the end of 2026, the reorganization program is mainly based on a critical self-assessment: Evonik needs to increase its operational speed by decreasing their amount of hierarchy levels (currently 10 below C-level to future 6) and their management/employee-ratio (from 1:4 to 1:7) [4]. The reorganization efforts thus mainly affect management and leadership positions.

Due to the lack of reliable data, a comparison to average amounts of hierarchy levels or management/employee-ratios in the chemical industry was not possible.

However: As already discussed in our article on the challenges of the chemical industry in 2024 [LINK], these and similar kinds of reorganization/restructuring programs are more than necessary for European chemical companies to stay relevant and shed off some “wealth baggage” (such as management/leadership overhead) accumulated in more prosperous times of the past.

If successful, Evonik’s current situation and restructuring program could become a prime example for other EU (and maybe US) chemical companies in the upcoming years: being self-aware, realizing your own pain points, mitigating bottle necks and challenging the status quo will lead to short-term pain for employees and shareholders, but will give rise to the chance for staying competitive long-term.

Exemplary case “localization”: India

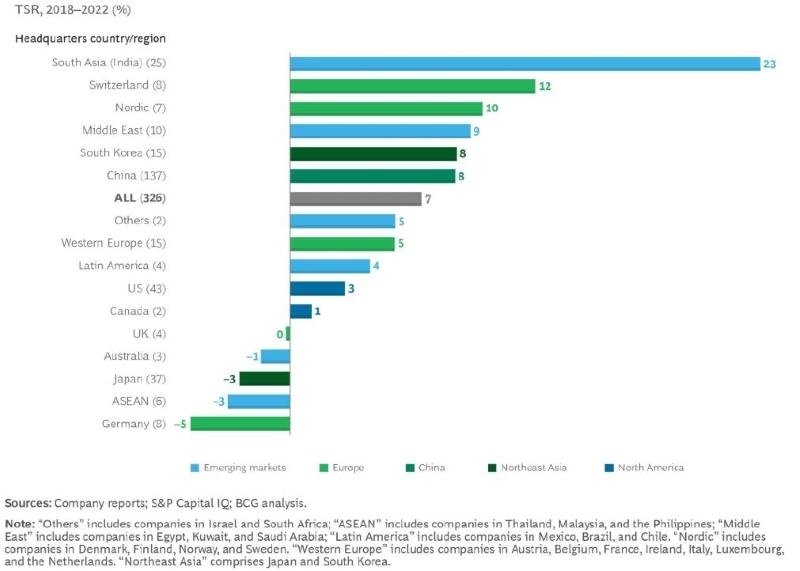

Measured on the median five-year TSR in 2018-2022, Indian chemical companies exhibit the highest TSR of all analysed regions in Figure 2, namely 23% - almost 2x of second-in-line regions Switzerland (12%) and almost 4x compared to China (8%) [2].

Figure 2 – Vertical bar chart depicting the median five-year Total Shareholder Return (TSR) in the period of 2018-2022 (in %) for different countries/geographical regions. The bar color represents different regional groupings, as shown in the graph. [Boston Consulting Group]

Figure 2 – Vertical bar chart depicting the median five-year Total Shareholder Return (TSR) in the period of 2018-2022 (in %) for different countries/geographical regions. The bar color represents different regional groupings, as shown in the graph. [Boston Consulting Group]

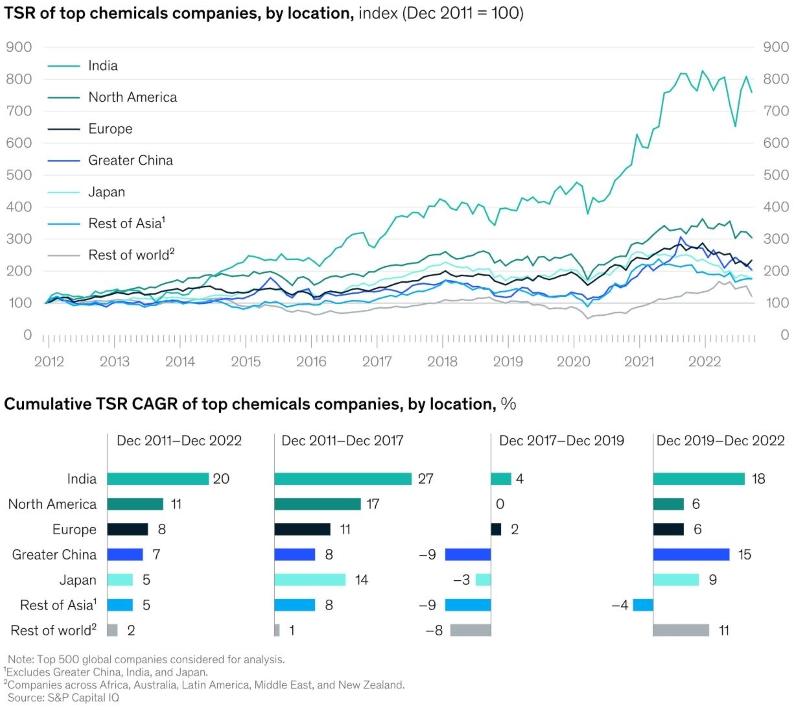

This trend of TSR increases is not only limited to five years but has been steadily increasing for over a decade, a McKinsey study shows (see Figure 3) [5] – whereas Indian chemical companies significantly outperform all other analysed regions.

Figure 3 – Top: Total Shareholder Return (TSR) of top chemical companies by location. Bottom: Cumulative TSR CAGR (Compound Annual Growth Rate) of top chemical companies by location. Depicted in both graphs are the regions: India, North America, Europe, Greater China, Japan, Rest of Asia and Rest of World. [McKinsey & Company]

Figure 3 – Top: Total Shareholder Return (TSR) of top chemical companies by location. Bottom: Cumulative TSR CAGR (Compound Annual Growth Rate) of top chemical companies by location. Depicted in both graphs are the regions: India, North America, Europe, Greater China, Japan, Rest of Asia and Rest of World. [McKinsey & Company]

Where is this impressive growth coming from?

According to the Department of Chemicals and Petrochemicals of the Indian Ministry of Chemicals and Fertilizers, the Indian chemicals and petrochemicals market offers several competitive advantages over other markets [6]. These are mainly:

A strategic geographical location for supply chains shifting due to geopolitical scenarios,

One of the lowest manufacturing labour wages in the world,

Highest workforce availability after China’s,

One of the lowest infrastructure costs in the world (construction, material and/or machinery costs) and

Major incentives, credit/investment opportunities, cost reimbursements and/or subsidies provided by state governments and industry policies.

For a deep dive into the overall Indian chemicals market, I highly recommend studying source 6.

Additionally, huge governmental initiatives are rolled out to address India’s formerly weak infrastructure [21]:

Gati Shakti, a.k.a. the National Master Plan for Multi-modal Connectivity, “is worth 1.2t USD and aims to streamline the planning process and ensure that resources are effectively directed towards development planning. The different divisions of the governments will now have a platform to work together on infrastructure projects such as roads, railways, airports, ports, mass transport and waterways”,

The National Infrastructure Pipeline (NIP) “involves an estimated funding of more than 1t USD over five years and includes projects in the renewable energy sector expected to actively involve private participants”, and

A sovereign wealth fund, the National Investment and Infrastructure Fund (NIIF), “was set up to manage investments and is intended to serve as a platform for co-investment by global and domestic investors and multilateral development banks (MDBs). The fund’s primary focus is on infrastructure and growth equity”.

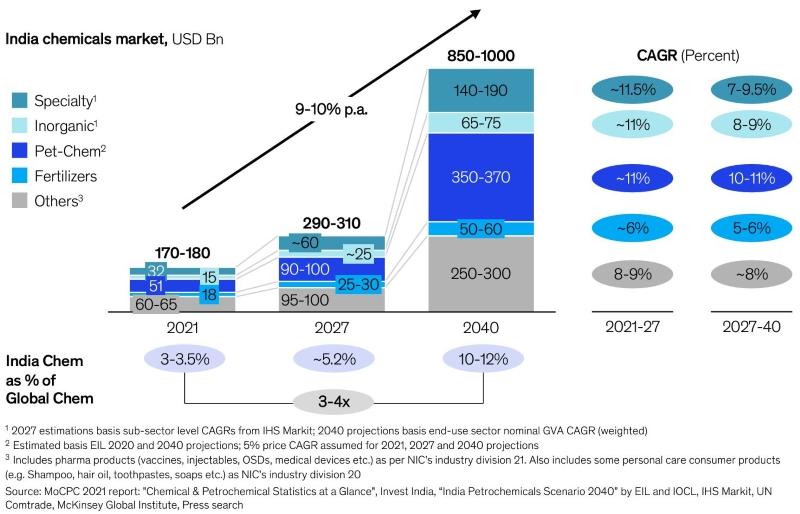

Interestingly, the specialty segment is currently the second strongest pillar of India’s chemicals sector after the petrochemical sector and is expected to grow steadily over the next decades (see Figure 4) [5].

Figure 4 – The Indian chemicals market in billion USD divided into several chemical subsectors: Specialty, Inorganic, Pet-Chem, Fertilizers and Others. Depicted are current market sizes and estimations for the subsectors for the years 2021, 2027 and 2040 as well as projected CAGR for the periods of 2021-2027 and 2027-2040. [McKinsey & Company]

Figure 4 – The Indian chemicals market in billion USD divided into several chemical subsectors: Specialty, Inorganic, Pet-Chem, Fertilizers and Others. Depicted are current market sizes and estimations for the subsectors for the years 2021, 2027 and 2040 as well as projected CAGR for the periods of 2021-2027 and 2027-2040. [McKinsey & Company]

India’s chemical industry boasts impressive economic growth over the last 10 years, especially in the last 5 years. Also, it’s 115b EUR in chemicals sales puts it in 7th place in world chemical sales rankings for 2022 – behind China, EU27, USA, Japan, South Korea, and Brazil (in that order) [1]. Simultaneously, India’s market share on the world chemical sales is only 2% [1]. The goal of the Indian chemical industry is to become a 300b USD industry by 2025 [6].

While localization is undeniably an important factor for India’s current industrial growth, it’s certainly not the only one: low labour and production costs, high workforce availability and attractive governmental business incentives for companies and entrepreneurs are also main contributors for this rapid development.

Funnily enough, most of these success factors are the direct opposites of why the German chemical market is currently under a lot of pressure (as discussed in our previous article [LINK, about the current challenges of the chemical industry in 2024]).

In future iterations of this article, we will look back at these two exemplary cases and see if there are novel insights or tendencies. Additionally, we will also look whether this “trend” in specialisation and localisation continues – or if it was just a short-lived phenomenon.

Future drivers for demand

Regardless of product portfolio specialisation, geographical areas, or any financial data: there is no alternative to the chemical industry. It’s the basis or an integrated part of value chains of almost every other industrial sector.

The good aspect about this: there will always be a chemical industry.

The bad aspect about this: Therefore, the chemical industry must always adapt to the current business climate as well as to the demands and needs of its customers. Relying or even relaxing on an outdated status quo won’t work long-term. The status quo must constantly be redefined by including innovation, R&D and market analyses.

Let’s take a look into our analytical crystal ball and raise the question:

What are future demand drivers for the chemical industry?

Based on our own experience and according to two analyses conducted by Deloitte, sustainability and its downstream initiatives to reduce emissions are key drivers in the short- to mid-term future of the chemical industry [7, 8]. These are mainly concerning the energy transition, bio-based feedstocks, and recycling technologies.

Energy transition

Advanced materials play an important role in the energy transition, in reducing weight or increasing durability of novel products. Reducing wear and maintenance leads to longer product life cycles, reducing weight increases fuel/energy efficiencies and using specialized high-performance materials enables novel technologies and application scenarios.

Applications for advanced materials in the energy transition, the energy infrastructure and many downstream technologies are:

Wind turbines,

Insulating materials,

Solar panels,

Superconductors,

Batteries (and other forms of energy storage),

Catalyst technology

to produce sustainable fuels, Hydrogen or Hydrogen carriers (such as Ammonia or Methanol),

other power-to-X(-to-Y) applications, or

carbon removal technologies (direct air capture “DAC”, carbon capture and storage “CCS”, or carbon capture and utilization “CCU”).

Additionally, these demands are not limited to just the production of the finished products listed above but are accompanied by other chemical products used in intermediary steps – such as solvents, lubricants, adhesives, catalysts and more. Dedicated and specialized production machinery, analytical equipment and benchmarking solutions are further needed to ensure high quality and standardization.

Bio-based feedstocks

Outside the energy transition, sustainability has unsurprisingly been a demand- and innovation-driver for the chemical industry in recent years. Finding “clean” alternatives to the “dirty” oil-based chemistry of the past has led to the uprise of several new production and recycling technologies.

As our startup & technology scouting work at 5-HT shows, one of the strongest trends in recent years revolved around using alternative feedstocks for chemical synthesis or production.

Renewable, bio-based alternatives to food chemicals/ingredients, lubricants, monomers, additives, or polymers can be obtained from various sources, which are categorized into “generations”:

1st generation feedstocks: from edible crops, such as sugarcane or corn,

2nd generation feedstocks: from non-food biomass, such as food waste or agricultural/forestry waste,

3rd generation feedstocks: using microorganisms (algae, bacteria, fungi) to harvest desired chemicals already present in those microorganisms,

4th generation feedstocks: utilizing synthetic biology to engineer microorganisms, which synthesize a desired chemical in high quantities and purity.

While 1st generation feedstocks compete with food supply and production, this issue is mitigated in all next-generation feedstocks. As apparent in 3rd and 4th generation feedstocks, the utilization of microorganisms blurs the traditional line between biology and chemistry - giving rise to a plethora of chances for the chemical industry by incorporating advances in synthetic and molecular biology into the production of sustainable materials.

Using a combination of recent advances in digitalization and automation, a possible scenario for 5th generation feedstocks could be engineered microorganisms, whose modification has been optimized in silico and processes are being performed by autonomous robots.

Recycling technologies

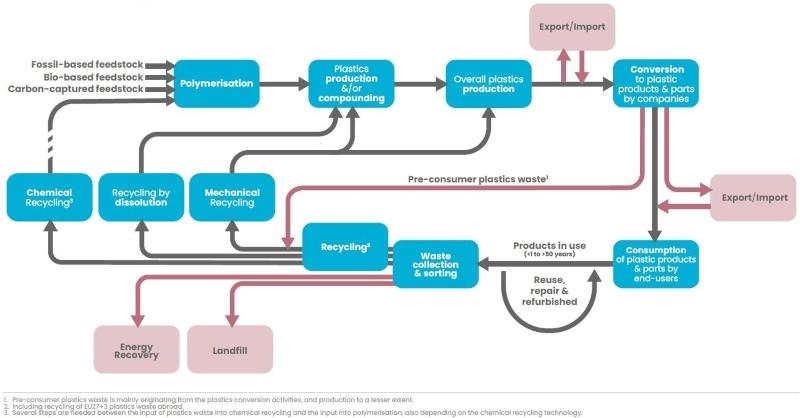

As resources become scarcer, plastic waste can be found in every ocean (or even the human body [9]) and life-cycle assessments become an industry standard, recycling technologies become more abundant. Circular economy is the newest line of approach. Figure 5 shows an overview of the circular plastics economy [10]:

Figure 5 – Overview of the Circular Plastics Economy depicting several streams of plastic production, utilization, and recycling. [Source: Plastics Europe]

Figure 5 – Overview of the Circular Plastics Economy depicting several streams of plastic production, utilization, and recycling. [Source: Plastics Europe]

As shown in figure 5, there are several ways to re-utilize and re-circularize plastic products:

Reuse, repair and refurbishment,

Mechanical recycling,

Recycling by dissolution and

Chemical recycling.

Reuse, repair and refurbishment are trending and viable options to circularize plastics, especially for consumer-based products.

Since final plastic products are often heterogeneous mixtures of different plastics, mechanical recycling often leads to a heterogeneous mixture of recycled materials. This makes their reutilization difficult (if not impossible) in scenarios, where high purity grades are necessary to produce new materials - for instance in the production of advanced materials. Mechanically recycled plastics are therefore often used as filler materials or additives in combination with standard plastics or engineering plastics for low-tech applications.

Recycling by dissolution can be used to selectively dissolve certain components in multicomponent plastics or products, that are notoriously difficult to recycle mechanically. However, this approach requires the use of solvents, as well as energy input for solvent removal and purification afterwards.

Chemical Recycling revolves around turning plastic (polymers) back into its individual building blocks (monomers). This allows the monomers to be reused in early stages of polymer production, where they can also be turned into different products than before by using different combinations of monomers or polymerisation techniques. While chemical recycling enables the closest-to-perfection approach for circularity, it’s simultaneously the most high-tech and sophisticated recycling technology of the mentioned: most often, the recycling process must be fine-tuned to a specific to-be-recycled polymer.

For a detailed review of the current recycled plastics situation in Europe, I highly recommend studying source 10.

Talking to peers, I recently very often hear the phrase “sustainability is dead”. Not in the sense of being irrelevant/inconsequential, but in the sense of overhyped, overused and worn out. In 2023, BlackRock-CEO and founder Larry Fink also famously announced towards Fox Business, that he won’t use the term “ESG” anymore, for it being overused and weaponized [11; ESG: Environmental, Social and Corporate Governance].

Although we might currently be in a period of disillusion (see Gartner Hype Cycle, Gartner Group) [12], the topic of sustainability will be on business agendas for many years to come. Especially when sustainability is and will be an integral part of our industry’s future development, e.g. via the European Green Deal.

Digitalization is dead, long live digitalization!

As part of the Digital Hub Initiative (de.hub Initiative) of the German Federal Ministry for Economic Affairs and Climate Action (BMWK), 5-HT Chemistry & Health has been working on fostering innovation and digitalization in the chemistry and healthcare industry for 6 years now.

Therefore, 5-HT has been fortunate to get a good understanding of the ups and downs of various trends regarding the digitalization of the chemical industry. This not only encompasses R&D laboratories, but also production and general business topics - such as IP-, knowledge- and data-management.

While some digitalization tools, like LIMS (Laboratory Information Management Systems) and ELNs (Electronic Lab Notebooks), have been around for several decades now, technological advancement is currently happening at break-neck speed and offers solutions for many areas in- and outside of the lab, including:

Audit trailing,

Data management and exchange,

Advanced statistics and statistical prediction,

Inventory and equipment management,

GHS management or

Employee training.

Combined with specific technologies – e.g. Virtual/Augmented Reality (VR/AR), Blockchain, (generative) Artificial Intelligence (AI) or IoT-solutions (Internet of Things) – many dedicated solutions tailored to the chemical industry have emerged, such as:

Self-Driving Labs (SDLs): Fully automated synthetical and/or analytical labs utilizing robotics, IoT-sensors, and closed-loop systems to increase productivity and reproducibility of experimentation,

Voice-based lab assistants: Using natural language processing (NLP) and specialized vocabulary recognition, voice-based lab assistants offer a hands-free solution to guide scientists through protocols or help them to take notes – mitigating data loss, reducing failure rates while increasing reproducibility and data integrity,

In silico R&D: In the past, chemical innovation was often based on trial-and-error in the lab. With increased costs, shorter development cycles and vastly increased computational power, it’s more feasible to research and develop novel molecules or composites digitally first. Leveraging chemical datasets with millions of compounds and synthetic routes, AI systems are now able to generate and retrosynthesize novel molecules with desired properties using advanced machine learning (ML) algorithms,

Digital Twins and XR-based training: Digital twins of production plants or labs can be used for infrastructure planning, process optimization or training scenarios. Especially in combination with mixed reality (XR) solutions, this can offer an immersive experience during the risk-free training of employees for working in specific parts of a plant/lab or performing certain procedures there (cleaning, maintenance, …).

Since the number of specialised solutions is almost as big as the number of chemical companies and startups globally, these are only some of the various solutions we have seen over the last few years. While we could perform in-depth analyses of these general applications or specific solutions, in this article we’ll focus on the critical analysis of the chances digitalization in general is able to offer.

Why is digitalization dead then?

At first glance, we live in the most-digitalized times ever. Following the digitalization waves of 2020 during the COVID pandemic and 2023 after generative AI software ChatGPT became open to the public, many digitalisation projects were started and successfully implemented.

Four examples:

Henkel developed its AI-based digital business platform “RAQN”, a multifunctional digital commerce and marketing tool, to personalize individual content along the customer journey [13],

LANXESS has implemented a self-service analytics system, called “TrendMiner”, to collect and analyse time-series data in many areas of its global plant fleet (covering almost two thirds of its global plants) to increase capacity, improve product quality and much more [14],

Procter & Gamble (P&G) utilizes AI to trace origination and content specifications from raw materials or packaging, down to the shelf and to the consumer. It's also helping to optimize energy and water consumption in the plants: Data from sensors is sent to the cloud where AI models are built and then redeployed to optimize efficiency [15],

“Merck […] has launched ChemisTwin™, […] [a] digital reference materials platform that can perform automatic analysis of samples’ purity, identification, and degradation of compounds through calibrated algorithm-based digital references” [16].

Although there are certainly many successful implementations of digitalized products, solutions and services, our own experience in scouting these technologies and exchanging with peers is as follows:

Most digitalization projects never truly go beyond initial proofs of concepts or the status of being “nice to have”. The problem: digitalization, and therefore also digital transformation, is not simple, it’s not done overnight and there is no one-stop-shop solution that fits every company. It may be trivial to explicitly state this, but:

Digitalization is expensive, time-consuming and is prone to offer an undefined ROI!

This is in direct contrast to usual application scenarios for digitalized products or services, which are often are focusing on reducing costs and increasing efficiency.

Quite often, digitalization projects are and remain lighthouse-projects – rarely implemented outside singular business units and mostly implemented as internal and external marketing showcases.

A bitkom query from 2023 shows, that 52% of German companies are not planning to implement AI-based solutions, even though 68% of the questioned companies believe AI to be the most important technology of the future [17]. While these results may not be representative for the German (or global) chemical industry, they highlight a huge problem many companies – especially SMEs – have in general: a lack of business plans and strategies to implement general digitalization technologies or specific digital solutions. This also raises the question, where this lack/hesitation is coming from:

A lack of understanding regarding the technology?

Uncertainty of the outcome/value of digitalisation implementations?

An unclear return-of-investment (ROI) of digital projects?

And even if digitalisation strategies and plans exist in a company, in combination with the present high speed of technological development they are prone to become outdated fast – sometimes even overnight.

Therefore, digitalization strategies must be focused on

raising the general digitalization level/readiness of a company,

being flexible/agile and

implementing general technologies, rather than being focused on one specific tool.

Establishing a flexible and reality-based digitalization strategy represents one of the biggest chances for companies in the chemical industry.

Long live digitalization!

Even though there is no one-size-fits-all solution for every company, a solid digitalization strategy focuses on three main aspects: data (and its usage), infrastructure and application:

Data

Digital processes

Data-driven decision making

Data-driven business operations

Infrastructure

Human application

Let’s look at data and its usage first before ending with a personal note on the human application of digital technologies.

While technological infrastructure is very important, this article will limit the discussion of this aspect to the following summary: Technological infrastructure needs to balance the aspects of security (cybersecurity in general, access management, etc.) and usability (availability, accessibility, ease-of-use, etc.).

Data as an asset and feedstock

The phrase „data is the new oil” was first coined by British data scientist Clive Humby in 2006: In his talk at a conference for the Association of National Advertisers he claimed, that, just like crude oil, raw data must be processed to become useful and valuable [18]. However, his phrase has become overused and misused - in the sense that, just like crude oil, data is becoming the next feedstock for the chemical industry.

In the end, both interpretations are true for the chemical industry: data is valuable, if correctly processed, and it’ll be the feedstock of the future.

Important factors for using data in such a way are the amount of data available and its quality.

Especially German chemical companies have a long history of R&D and production. Globally active companies like BASF and Bayer were founded in the 1860s and the oldest chemical company is Merck, with its foundations reaching back to 1668.

This long history is equivalent to hundreds of years worth of data!

But just like in those days, a lot of chemistry done today is still recorded on paper. Future data capture/recording is best done digitally, while sophisticated technology can be utilized to digitalize old paper-based science [19]. To facilitate and ensure high data quality, chemical companies are heavily investing in data science & analytics tools and personnel [20].

Once enough high-quality data has been gathered, it can be used to drive digital processes, ensure data-based decision making and business operations. A detailed analysis of these aspects for the chemical industry as well as real world examples of solutions can be found in this article [coming soon].

Combining new and old data with novel tools and technologies can lead to a better understanding of current processes or synthetic routes, enables optimization, and leverages already existing knowledge inside an organization. This once again leads to innovation as well as novel products – making data the newest feedstock for the chemical industry.

Human application of digitalization: A tool is only valuable while being used

As mentioned before, this section is more of a personal note based on own experiences rather than a scientific analysis.

Even though we deem ourselves the pinnacle of creation, we humans are quite simple: We enjoy convenience and observable results. We use the tools most available to us, that get the job done quickly. A trivial, but (in)famously well-known example is the German creativity of opening a beer bottle with anything but a bottle opener.

Translated into the not-as-trivial world of the digitalization of science and chemistry:

A lab technician will rather use digital tools familiar to them (like Microsoft Word or Excel) to record data and experiments, than dedicated and specialized tools they are not familiar with - leading to issues with data quality and integrity,

If a process or software program is too complex and/or time-consuming, a work-around or shortcut will most likely emerge over time,

The same applies to assets and tools (like workstations or computers) that are not located next to the place of need,

If a technology is not understood well enough, results might not be trusted by employees, leading to misinterpretation, unnecessary duplication of results and/or lack of use.

What’s the use of a LIMS or ELN, if your employees find it too cumbersome to use while working and record everything on paper first – only to later input it manually into the system?

What’s the use of state-of-the-art computer workstations in an office area, when your employees do all calculations, analyses and reports next to their analytical equipment in the lab?

What’s the use of digital training tools (e.g. video-based or XR-based), when the employees that are responsible for the training of new employees are not familiar with these tools/technologies and do the training “the way it has always been done”?

As extensively discussed above, digitalization offers a lot of chances for the chemical industry. But every Euro and time invested into technology, which is not used in the end, is unfortunately wasted.

Accordingly, success in digitalization heavily depends on the understanding, acceptance, and application of the people in contact with it.

Digitalization therefore needs to be human-centered first, before becoming process- or technology-centered. This again highlights the importance of analyzing processes, knowledge and employee readiness prior to implementing digital tools.

While short-term marketing showcases or lighthouse projects are nice-to-have, the focus of such projects should be on realizing their value for long-term scenarios – and therefore making these projects a must-have.

Summary

The chemical industry is currently facing several challenges, which will likely still be present in the next few years: China has a strong influence on the global chemical market, while Europe and the US steadily lose their share. Additionally, albeit being necessary, sustainability-driven regulations like the European Green Deal threaten to negatively impact the chemical industry further on their way to reach a net-zero future.

At the same time, many chances are currently present that can be leveraged to overcome or mitigate these problems:

Specialization and localization, combined with self-critical assessments, clear goals for the future and incentives for innovators can lead to new flexibility and agility in old structures as well as outstanding steady growth over many years for some markets & segments,

By addressing future drivers for demand in the energy transition, bio- based products & feedstocks and combining them with innovative recycling technologies, the chemical industry itself and its customers can pave the way to a greener and more sustainable future – bringing net-zero closer to reality,

Using existing knowledge and data together with purposefully implemented digital tools, chemical companies will be able to become more efficient and future-proof through data-driven processes, decision-making and business operations.

Although not explicitly discussed in this article, leveraging existing assets and ecosystems offers exceptional chances, too. There is no such thing as a perfect company or economical market, putting everyone in the chemical industry (at least to some degree) into the same boat.

The chemical industry is one of the most integrated industries and therefore also one of the most complex ones. In some form or another, chemistry - and the industry behind it - was, is and will always be necessary for everyone. We just have to figure out, how.

__________________________________

Our aim is to publish an updated and revised version of this article focusing on the current chances of the chemical industry at least once per year.

Comments, questions, and discussions regarding this article are therefore highly appreciated! Feel free to contact the author of this article, Alex Böser (Senior Ecosystem Manager Chemistry @ 5-HT), via e-mail [alexander.boeser@5-ht.com] to share your opinion.

Sources

[1] Cefic Chemdata International (2024). 2023 Facts and Figures of the European Chemical Industry. Cefic website: https://cefic.org/a-pillar-of-the-european-economy/facts-and-figures-of-the-european-chemical-industry/

[2] Gocke et al., Boston Consulting Group (BCG) (2023). Value Creation in Chemicals 2023 – Facing Unprecedented Pressures. BCG website: https://www.bcg.com/publications/2023/resilience-chemicals-industry

[3] Evonik Industries AG (15.03.2024). Evonik website: https://corporate.evonik.com/en

[4] Evonik Industries AG (2024). 4th Quarter/Full Year 2023 Reporting. Evonik website: https://corporate.evonik.com/en/investor-relations/reports/quarterly-reports/q4-2023

[5] McKinsey & Company (2023). India: The next chemicals manufacturing hub. McKinsey website: https://www.mckinsey.com/industries/chemicals/our-insights/india-the-next-chemicals-manufacturing-hub#/

[6] A. Kapoor, S. Negi, Institute of Competitiveness, Department of Chemicals and Petrochemicals, Ministry of Chemicals and Fertilizers, India (2024). India’s Booming Chemical And Petrochemical Industry - Understanding Industry Landscape. Indian Ministry of Chemicals and Fertilizers website: https://chemicals.gov.in/latest-news/indias-booming-chemical-and-petrochemical-industry-understanding-industry-landscape

[7] Yankowitz et al., Deloitte (2024). 2024 chemical industry outlook. Deloitte website: https://www2.deloitte.com/us/en/insights/industry/oil-and-gas/chemical-industry-outlook.html

[8] Yankowitz et al., Deloitte (2023). The future of materials. Deloitte website: https://www2.deloitte.com/us/en/insights/industry/oil-and-gas/the-future-of-materials.html

[9] Heather A. Leslie, Martin J.M. van Velzen, Sicco H. Brandsma, A. Dick Vethaak, Juan J. Garcia-Vallejo, Marja H. Lamoree (2022). Discovery and quantification of plastic particle pollution in human blood. Environment International, Volume 163, 107199, ISSN 0160-4120, https://doi.org/10.1016/j.envint.2022.107199.

[10] Plastics Europe (2024). The Circular Economy for Plastics, A European Analysis, Executive summary. Plastics Europe Website: https://plasticseurope.org/knowledge-hub/executive-summary-the-circular-economy-for-plastics-a-european-analysis-2024/

[11] Fox Business News (2023). Fox Business website: https://www.foxbusiness.com/media/blackrock-fink-wont-mention-esg-anymore-been-weaponized-left-right

[12] J. Miller, Brunswick Group (2023). Beyond the ESG hype cycle: Adopting an 'activist mindset' to doing business. Published as opinion article on the website of the World Economic Forum: https://www.weforum.org/agenda/2023/08/heres-where-we-are-in-the-esg-investing-hype-cycle/

[13] Henkel (2021). Henkel website: https://www.henkel.de/presse-und-medien/presseinformationen-und-pressemappen/2021-07-13-henkel-geht-strategische-partnerschaft-mit-adobe-ein-1264272

[14] LANXESS (2020). Lanxess website: https://lanxess.com/en/Media/Press-Releases/2020/01/LANXESS-digitizes-its-global-asset-base

[15] Procter and Gamble (2023). Innovation Expo Live Podcast Uncovers P&G's Science-Based Innovation. P&G website: https://us.pg.com/blogs/pg-european-innovation-expo-live-podcast-series/

[16] Merck (2023). Merck Launches ChemisTwin™, First Ever Digital Reference Materials Platform for Analytical Testing. Merck website: https://www.sigmaaldrich.com/DE/de/collections/press/chemistwin-launched-digital-reference-material-platform-analytical-testing

[17] bitkom e.V. (2023). Deutsche Wirtschaft drückt bei Künstlicher Intelligenz aufs Tempo. bitkom press release: https://www.bitkom.org/Presse/Presseinformation/Deutsche-Wirtschaft-drueckt-bei-Kuenstlicher-Intelligenz-aufs-Tempo

[18] https://en.wikipedia.org/wiki/Clive_Humby

[19] T. Gressling, Bayer AG (2024). Semantic Enrichment and Contextual Imputation of Incomplete Lab Journal Data. Talk at ACS Spring 2024 in New Orleans.

[20] HRForecast on behalf of BAVC and IGBCE (2024). The Future Skills Report Chemistry 2.0 - An AI-based trend analysis on the future skills of the chemical and pharmaceutical industry. Available at: https://future-skills-chemie.de/

[21] R. Khanna, A. Tomar, Norton Rose Fulbright (2024). When it comes to infrastructure building, is India the next land of opportunity?. Norton Rose Fulbright website: https://www.nortonrosefulbright.com/en/knowledge/publications/ada6d415/when-it-comes-to-infrastructure-building-is-india-the-next-land-of-opportunity

Related posts

You may be interested in these articles:

5-HT Chemistry & Health Newsletter

Want the latest tech and industry news, events, relevant info from the ecosystem and more?

Subscribe to 5-HT Newsletter now Subscribe to 5-HT Newsletter now

Become part of the 5-HT Chemistry & Health

Exchange ideas with innovative startups and future-oriented companies in our ecosystem. We look forward to meeting you!