Starting a business in Germany

Overview of rules and processes.

The steps required to incorporate a company in Germany depend primary on the type of business one wants to establish.

For international expansion, opening a branch or a subsidiary or moving the headquarters of your company to Germany are several possible options.

A branch office is a direct extension of the already existing company. It serves a specific geographic region and can take over core activities such as sales and contracting. However, the branch is not a separate legal entity from the parent company. Therefore, it does not provide liability protection for the parent company. In addition, company-wide profits may be subject to taxation in the country of the branch.

A subsidiary is legally somewhat more complicated than a branch office. It is a legal entity completely separated from the parent company, which provides liability protection. In addition, it is only subject to taxation in the country of the subsidiary, which limits the impact of local tax laws on the parent company as well.

Legal entities / representatives

Choose a suitable legal form

The GmbH (limited liability company) is the most common and generally preferred form of limited liability company in Germany. A share capital of at least 25,000 Euro is required to establish this form of company. The company is legally represented and managed by the managing directors. There must be at least one managing director, but he or she does not have to be a shareholder or a German resident.

The estimated cost of establishing a GmbH lies between 730 and 1,000 euros, not including the fees for legal counsel. Only after the registration of the company in the Commercial Register, the company may start its activities.

We have compiled further information for you on the advantages and disadvantages of GmbH, UG and GbR.

For further information on starting a company in Germany, the following sources can be used:

-

UG or small GmbH

- Entrepreneurial company or limited liability company

- Limited liability

- Relatively few formalities

- Appointment of an external manager (third party)

- Tax benefits

- Higher reputation

- Compatible for investors (shares)

- Initial capital requirements (25,000/12,500 at the beginning)

- High costs and fees for legal formalities (notary, commercial register, trade register...)

- Requirement to have at least one local representative

- High standards on accountability

- Action constraint in reality often difficult to archive

-

GbR (civil law partnership)

- Partnership

- No initial capital required

- In general no formalities

- Lack of formalities problematic in the long term!

- Personal liability; also for potential investors

-

KG (limited partnership)

- Limited partnership in which the general partner is a limited liability company

-

AG (stock corporation)

- Capital company

In Germany there are several other legal forms of companies, for example:

Overview Advantages and disadvantages of a business company or small GmbH

Overview Advantages and disadvantages of a UG or Mini GmbH

How to hire employees

Finding the right employees in Germany

Employees are a decisive factor for the success of a company. In Germany, there are several ways to find employees.

You either use the public offer of the Federal Employment Agency, which offers its services free of charge and operates job centers throughout Germany, or you use online platforms such as StepStone, Monster or LinkedIn.

As an employer, you need to know the employment models in Germany.

Employees and social security

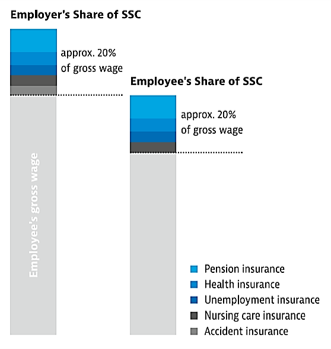

The following chart shows the social security components (SSC) in Germany.

So keep in mind: labor costs are not the only wage!

You must pay the employer's contribution to social security. Makes a total of about x 1.3 of the salary.

Wage and salary accounting

Employees in Germany receive a net wage, the contributions must be deducted beforehand.

- Wage tax directly deducted and electronically transferred to the tax office.

- Social security contributions Dpaid directly and transferred electronically to the health insurance funds.

- International social security agreements Please note in which national social security system the employee is insured based on the applicable international agreements.

-

Regular employment

- This is an employment relationship based on full-time employment under a permanent employment contract.

-

Limited contracts

- They expire automatically on a certain date, limited to two years, can be extended up to three times. In the first 4 years of the company's existence, contracts can be limited several times.

-

Unlimited contracts

- They are terminated by a written letter of termination with a mandatory notice period, usually with a probationary period.

-

Temporary employment

- The employees are provided by an agency, from which the temporary worker receives a salary. The maximum assignment period is 18 months.

-

Part-time

- Part-time work describes a working time model in which employees regularly work shorter hours than comparable full-time employees.

Employment models in Germany

The most common tax laws

Corporate taxation in Germany consists of three components.

Tax laws

1. Corporate income tax

There is no uniform tax rate in Germany. The corporate income tax is fixed nationwide. 15 percent of taxable corporate income.

2. Solidarity surcharge

The solidarity surcharge is fixed nationwide. Surcharge of 5,5 percent on the corporate income tax rate

3. Business tax

It is not set nationwide and therefore varies. Minimum is 7 percent, average is 14,06 percent (GTAI, 2018). Generally, it is higher in urban areas than in rural areas.

The overall tax rate varies between 22,83 and 29,98 percent (GTAI, 2020).

Taxation of dividends

If a German subsidiary distributes a dividend to a foreign parent company, the capital gains tax is generally 25 percent plus solidarity surcharge.

There are many international agreements to avoid such double taxation, so it is usually significantly reduced.

Value-added and sales taxes

The value-added sales tax (VAT) rate in Germany is 19 percent, with a reduced rate of 7 percent for certain goods such as food, public transport or printed matter.

In general, the end customer must pay the VAT.

The company must regularly pay the VAT received to the tax office.

5-HT Chemistry & Health Newsletter

Want the latest tech and industry news, events, relevant info from the ecosystem and more?

Subscribe to 5-HT Newsletter now Subscribe to 5-HT Newsletter now

Become part of the 5-HT Chemistry & Health

Exchange ideas with innovative startups and future-oriented companies in our ecosystem. We look forward to meeting you!