The future of the European Green Deal: Impact of the crisis and the EU chemicals strategy on the chemical industry

Katharina Kittelberger

With the European Green Deal, the EU Commission aims to achieve climate neutrality for Europe by 2050 and a sustainability-oriented restructuring of the economic system. As a result, national economies are faced with the challenge of transforming their economic systems in the direction of a green economy. The chemical industry in particular has a key role to play in this transformation.

Although the current events surrounding climate change, digitalization, Corona, supply shortages, the energy crisis and the war in Ukraine represent an immense additional burden, the German chemical industry is focusing on measures that are relevant to the future rather than those that safeguard its existence.

In this article, 5-HT addresses the current status of the Chemicals Strategy and previous forecasts related to the innovations in the Chemicals Strategy. In addition, we convey the impressions of the VCI and explain what the current underlying tone of the future of the European Green Deal is.

War and Corona, Climate Protection, Digitalization and the Circular Economy: Current Development Prospects for the Economy and the Chemical Industry

The momentum of the global economy weakened in the first quarter of 2022. Supply bottlenecks and high energy and raw material costs slowed growth in the industry. The Ukraine war exacerbated these problems, particularly in Europe. In its report on the economic situation of the chemical industry in Q1 2022, the German Chemical Industry Association (VCI) continues to avoid a quantitative forecast for the industry's development in 2022 as a whole due to the unforeseeable consequences of the war in Ukraine and China's zero-covid strategy.

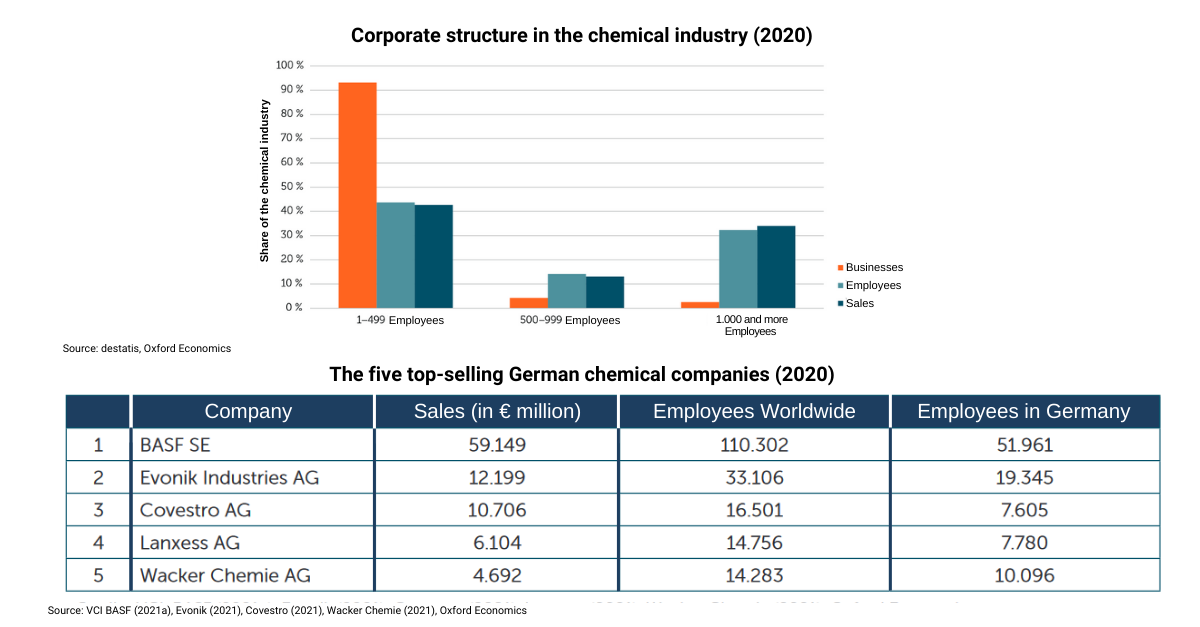

Why it is worth taking a look at the chemical industry with regard to current developments for the economy and the chemical industry becomes clear when one considers the scale of the industry (Stiftung Arbeit und Umwelt der IG BCE, 2021)

Why it is worth taking a look at the chemical industry with regard to current developments for the economy and the chemical industry becomes clear when one considers the scale of the industry (Stiftung Arbeit und Umwelt der IG BCE, 2021)Survey: Chemical managers rate current risks as business-critical

The survey conducted as part of the 38th CHE Monitor Trend barometer by Camelot Management Consultants and the trade journal CHE Manager revealed that three quarters of the chemical managers surveyed consider the current uncertainties and pressures to be business critical. The greatest concern at present is the price increases for gas and electricity.

In addition, the chemical industry faces other challenges that will have an impact in the short or medium term. The chemical managers most frequently mentioned the digital transformation (87%), which, however, also brings opportunities.

In addition, the ongoing pandemic (82%) and the disruption of global supply chains (80%) were perceived as major challenges. Political crises (57%) were on the agenda of only one-third of the survey participants before the start of the war; after February 24, 96% of the chemical managers surveyed saw their company affected by political crises.

EU Chemicals Strategy for Sustainability: The European chemical industry faces massive challenges

As part of the European Green Deal, the European Union (EU) presented its "Chemicals Strategy for Sustainability" (CSS) in October 2020, which contains numerous measures to protect health and the environment. In order to adequately prepare and take action, the chemical and pharmaceutical industry calls for constructive dialogue and a stable legal framework.

According to the VCI, the long legislative processes involved in the Chemicals Strategy are causing uncertainty in the chemical industry: Just one of the reasons for this is that the strategy is to introduce many innovations, some of which are currently very sweeping.

The innovations associated with the Chemicals Strategy pose further challenges for the chemical industry in the future that need to be overcome. In order to better assess the impact of the EU Chemicals Strategy on the economy, the European Chemical Industry Council (CEFIC) has conducted an initial study of the economic consequences. According to this study, 12,000 chemical substances alone could fall within the scope of the two pending legislative proposals: the amendments to the CLP Regulation and the application of a Generic Risk Approach (GRA).

The study also found that these substances could account for up to 43 percent of the European chemical industry's total sales, equivalent to around €214 billion.

The economic impact assessment shows that the upcoming reform of Chemicals Legislation will have a significant impact. It also states that, depending on the scenario, sales in the European industry could plummet by between €47 billion and €81 billion per year by 2040.

In addition, the number of available and usable chemicals in Europe would be significantly reduced. The result of this would be a threat to competitiveness, including innovations and products that are necessary for a sustainable transformation and the success of the Green Deal. The same applies to the functionality of value chains and crisis resilience.

However, a competitive chemical-pharmaceutical industry is essential to manage both the transformation and implementation of the Green Deal and the current crises.

European changes in chemicals law as a paradigm shift

According to the VCI, the announced amendments to the Chemicals Act would lead to a paradigm shift in chemicals legislation: What is striking here is that chemicals are to be considered much more danger-related in the future than they have been up to now. This approach is problematic, because the dangerousness of chemicals cannot and should not be the only criteria. Rather, the focus must be on how and for what purposes the respective substances are used.

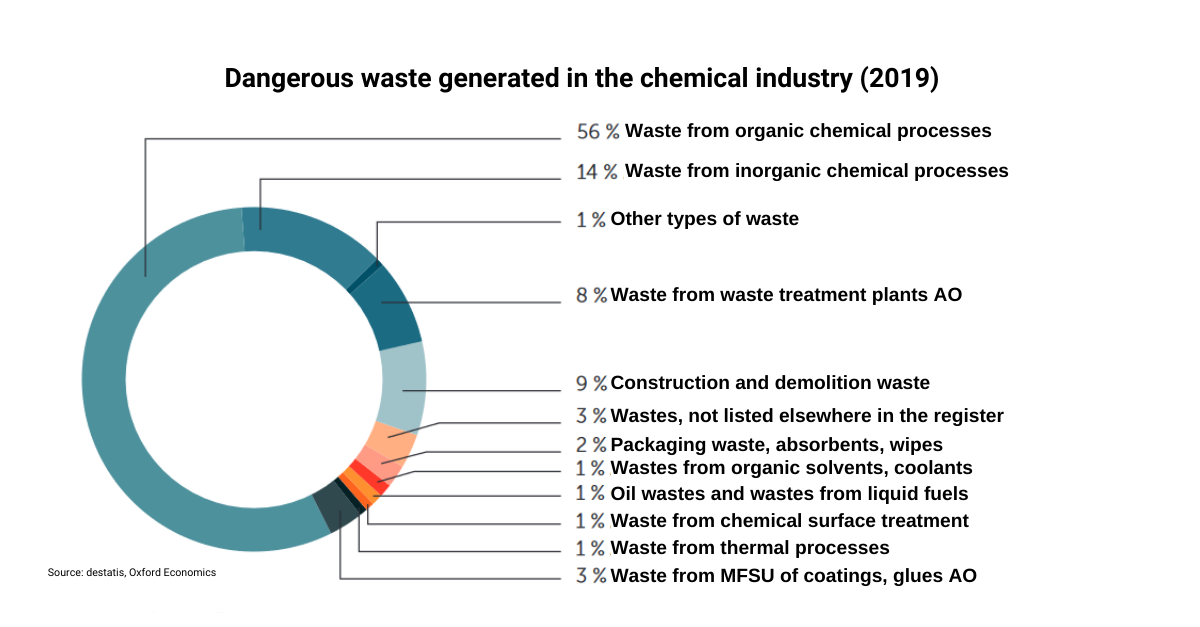

Between 2009 and 2019, the volume of dangerous waste in the German chemical industry increased by 28 percent. More than half of the waste volume was generated by waste from organic chemical processes in 2019. Also relevant are wastes from inorganic chemical processes (14%), construction and demolition wastes (9%), and wastes from waste treatment plants (8%). The aim here is to continue to reduce waste volumes and to duplicate the successes of the process optimizations here as well (Stiftung Arbeit und Umwelt der IG BCE, 2021)

Between 2009 and 2019, the volume of dangerous waste in the German chemical industry increased by 28 percent. More than half of the waste volume was generated by waste from organic chemical processes in 2019. Also relevant are wastes from inorganic chemical processes (14%), construction and demolition wastes (9%), and wastes from waste treatment plants (8%). The aim here is to continue to reduce waste volumes and to duplicate the successes of the process optimizations here as well (Stiftung Arbeit und Umwelt der IG BCE, 2021)As an illustration, lithium, which is dangerous as a starting material, forms the basis of lithium-ion rechargeable batteries. These are used safely in many electronic devices and in electric cars. Another example is alcohol, which has been proven to cause cancer. If the latter were to be banned on account of its dangerous nature, all the useful applications would be eliminated at the same time, such as the disinfectant that was so important in the Corona pandemic.

For this reason, the VCI describes the current system of REACH as functional, because it does not ban substances that are dangerous in themselves across the board, but rather checks how they are used beforehand.

Should the chemicals regulation lead to blanket treatments in the future, then substances could also be banned that are perfectly sensible.

REACH: Protracted negotiations unsettle the chemical industry

The Chemicals Regulation REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) has been the core of the European Chemicals Legislation since 2007. Among numerous other measures, REACH is to be reformed as part of the EU Chemicals Strategy. In preparation, a consultation was recently held in which the EU sought the opinions of various interest groups. Concrete proposals for amending the REACH Regulation are expected by the end of 2022. A legislative process lasting several years will then begin. It is currently unclear what the outcome will be.

Approved or banned? Continuous registration process under REACH

Any manufacturer or importer who wants to place substances falling within the scope of the REACH regulation on the market must register these substances.

In order to be allowed to trade in chemicals in the first place, chemical manufacturers must submit a registration dossier to the European Chemicals Agency (ECHA). The properties of the specific chemical are noted in this extensive data set.

Depending on the substance, aspects such as health properties, or data on toxicology or animal testing, are recorded to provide insight into which substances need to be regulated and which do not. This is an ongoing process as new chemicals are invented, discovered and developed.

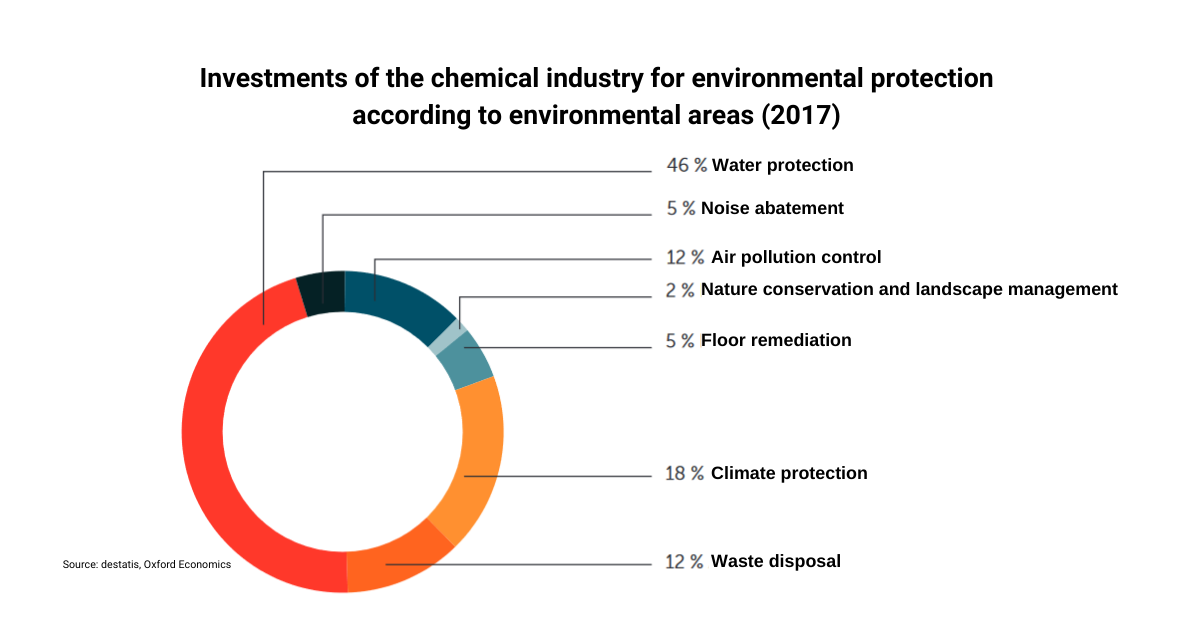

In the European ranking, Germany leads the volume of investment in the chemical industry, accounting for around 22 percent of investments in climate and environmental protection in the manufacturing sector. This corresponded to around 521 million euros in 2017. Just about half of this investment was spent on water protection, 18 percent on climate protection, and twelve percent each on air pollution control and waste testing (Stiftung Arbeit und Umwelt der IG BCE, 2021)

In the European ranking, Germany leads the volume of investment in the chemical industry, accounting for around 22 percent of investments in climate and environmental protection in the manufacturing sector. This corresponded to around 521 million euros in 2017. Just about half of this investment was spent on water protection, 18 percent on climate protection, and twelve percent each on air pollution control and waste testing (Stiftung Arbeit und Umwelt der IG BCE, 2021)To improve the quality of registration dossiers generated by the REACH rollout up to May 2018, the EU Commission and ECHA adopted a joint action plan at the end of 2019 comprising 15 measures (for example, more dossier reviews or the adoption of implementing rules for dossier updates). The VCI and its members are making their contribution with the multi-year "REACH Dossier Improvement Action Plan" of the European Chemical Industry Council CEFIC. It is implemented in close coordination with ECHA.

In recent years, more than 100,000 registration dossiers have been compiled in this way, creating the basis to produce chemicals.

Possible migration of chemical production abroad

The EU Commission emphasizes that changes to the Chemicals Legislation will not change the competitive conditions of European and non-European market participants. Nevertheless, a relocation of the production of energy-intensive products to countries with less stringent climate protection regulations is not unlikely.

However, climate neutrality is only possible with a competitive chemical industry, which is why enough renewable energies on competitive terms are needed to prevent a shift of production to regions with low environmental standards.

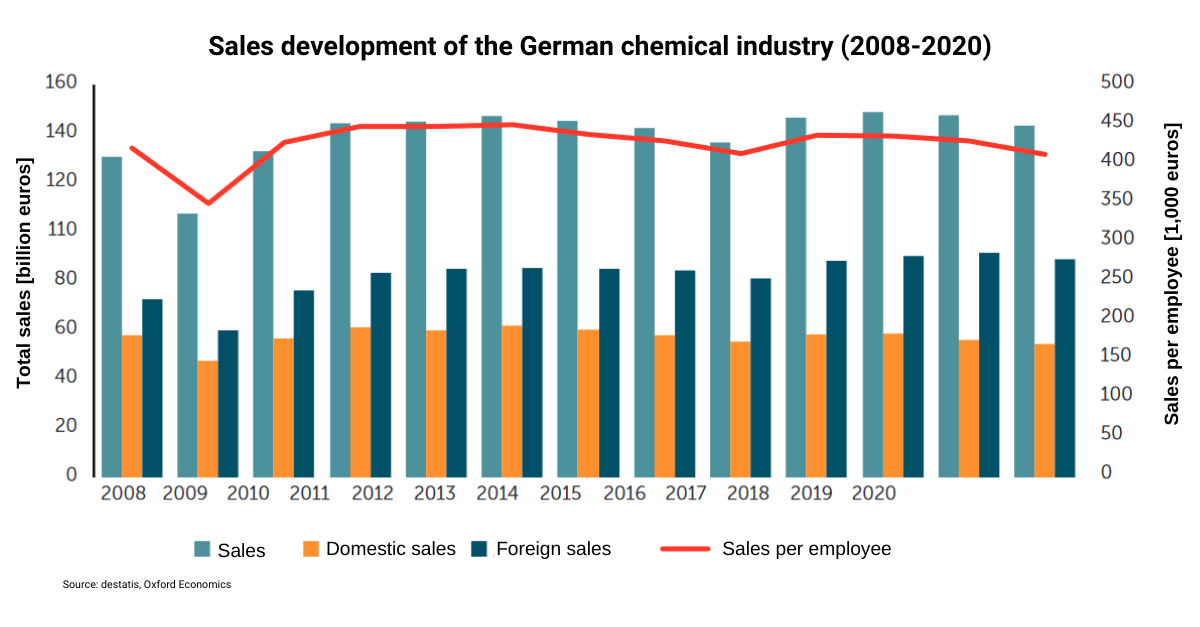

After an increase in sales numbers in the German chemical industry, the numbers are now stagnating or tending to fall (Stiftung Arbeit und Umwelt der IG BCE, 2021)

After an increase in sales numbers in the German chemical industry, the numbers are now stagnating or tending to fall (Stiftung Arbeit und Umwelt der IG BCE, 2021)From the VCI's point of view, it is important that the competitiveness and innovative ability of the chemical and pharmaceutical industries is maintained in the face of safety requirements that are high and increasing by international standards. According to the VCI, it will only be possible to assess whether this can be achieved after the current reforms.

Illegal imports: An import problem rather than one of chemicals regulation

Import checks on consumer products carried out under the EU Commission's RAPEX system mainly discover products originating in Asia that exceed certain limits.

The VCI emphasizes that the enforcement of existing and future legislation by the authorities must be ensured. Constant tightening of EU regulations that cannot be enforced, especially for imported products, would not help to raise safety standards, it said. Instead, it would weaken the competitiveness of European companies and make Europe unattractive as a business location.

How digitalization can help to reinforce trust

Since the REACH process is not only chemistry-based but also IT-based, digitization has a crucial role to play here. On the one hand, regarding cross-border European cooperation: This can only function so well because it runs via REACH-specific IT systems.

On the other hand, the processing and provision of databases on the Internet by ECHA can impart knowledge and make safety data accessible, which potentially leads to more transparency and trust.

But digitalization is also playing an increasingly important role outside of this: according to the VCI, chemical companies are using digitalization to optimize their processes, such as more efficient research in the laboratory.

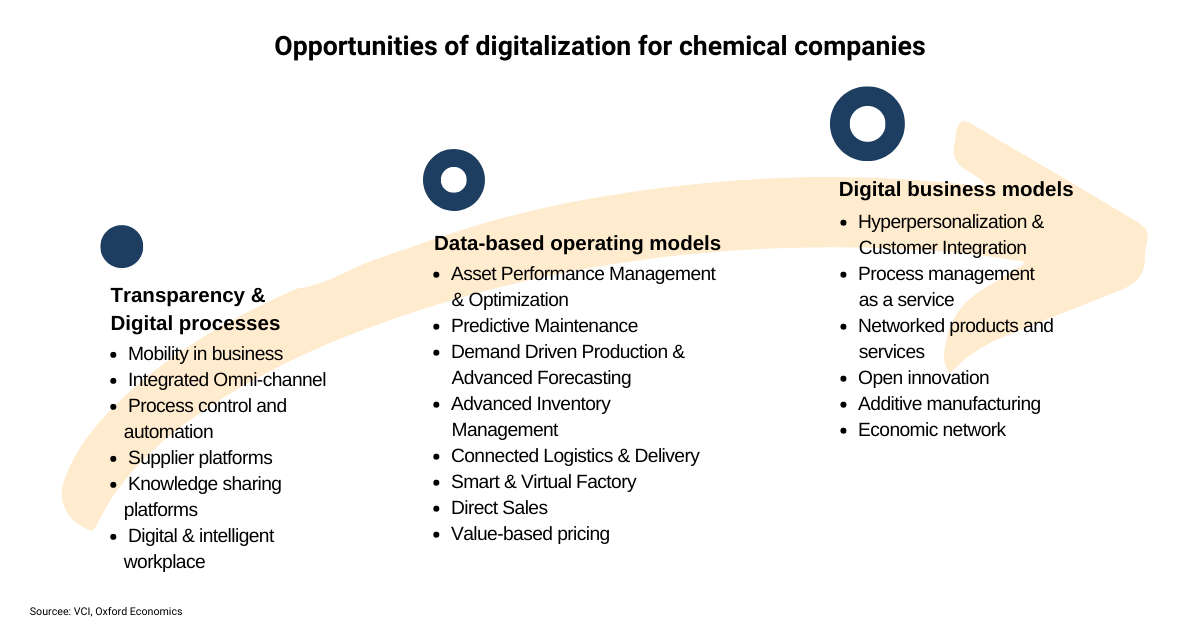

The VCI describes further opportunities of digitalization for chemical companies as follows:

In the course of digitization, a number of new opportunities arise for chemical companies (Stiftung Arbeit und Umwelt der IG BCE, 2021)

In the course of digitization, a number of new opportunities arise for chemical companies (Stiftung Arbeit und Umwelt der IG BCE, 2021)Consequently, there are a lot of connecting factors where digitalization can be supportive.

Unfortunately, it is not possible at the moment to provide a valid answer to the additional challenges posed by the rise in energy prices as a result of the war in Ukraine and how these can be overcome without significant competitive disadvantages for German and European chemical companies.

_____________

The German Chemical Industry Association (VCI), headquartered in Frankfurt am Main, Hesse, is the trade association of the chemical and pharmaceutical industry in Germany. Since its founding in 1877, the VCI has represented the economic interests of around 1,900 German chemical companies towards politicians, authorities, as well as other sectors of the economy and the media. The VCI is thus the point of contact for all economic issues and the voice for more than 90 percent of the German chemical industry.

5-HT Chemistry & Health Newsletter

Want the latest tech and industry news, events, relevant info from the ecosystem and more?

Subscribe to 5-HT Newsletter now Subscribe to 5-HT Newsletter now

Become part of the 5-HT Chemistry & Health

Exchange ideas with innovative startups and future-oriented companies in our ecosystem. We look forward to meeting you!